MOQ and Lead Times in Injection Molding from China

For startups, hardware teams, and pragmatic buyers, “What’s the real MOQ?” and “How long until I get parts?” are the first two questions that decide whether a project moves forward. If you’ve heard claims like “MOQ must be 5,000+” or “Lead time is at least eight weeks,” you’ve heard averages and anecdotes—useful, but incomplete. The truth is that realistic MOQ and lead time for small runs depend on a lot of things: mold strategy (aluminum vs P20), part complexity, materials, factory queue, and transport mode, plus the maturity of your DFM process. This guide gives you practical ranges you can use to set internal expectations and negotiate confidently with Chinese injection molding suppliers.

We’ll break down the two MOQs that matter (production and economic), show typical lead-time ladders for 200–2,000-unit runs, explain the five variables that usually move the goalposts, and close with negotiation checklists, case-style scenarios, and simple calculators you can adapt.

Section 1: The Two MOQs You Actually Need to Align

Most misunderstandings happen because people talk about different MOQs.

Production-Side MOQ

This is the factory’s minimum volume to justify setup time, machine changeovers, material purging, and yield stabilization. For small-batch China injection molding, production-side MOQ often falls between 200 and 1,000 units per batch when using a single-cavity aluminum or P20 mold for common resins like ABS/PP. Below ~200 pieces, the per-unit cost spikes due to setup and scrap amortization.

Economic MOQ

This is your break-even or “most sensible” minimum when you amortize mold cost into unit price and consider total landed cost. For common consumer/industrial parts in ABS/PP, the economic MOQ often is around 800–2,500 units, depending on mold cost, cycle time, and labor for secondary operations. Transparent PC, high-polish optics, and tight-tolerance parts push the economical threshold higher because of longer polishing, more iterations, and more care during production.

Key drivers for both

- Mold strategy and cavitation (aluminum vs P20; single vs multi-cavity)

- Material processability (ABS/PP are forgiving; PC, POM, PA+GF are more sensitive)

- Surface finish and color (high gloss, texture, two-shot, paint/printing)

- Inserts, overmolding, and downstream assembly steps

- QC rigor and rework policy (AQL levels, functional test scope)

Section 2: Typical Lead-Time Ladder for Small Runs (PO to First Shipment)

Think in milestones rather than a single number. This ladder assumes a 200–2,000-unit scope.

- DFM alignment: 2–5 business days

- Mold build: 10–18 days for aluminum or P20 single-cavity

- T1 sampling: +1–3 days

- T2/T3 optimization: +3–7 days per round

- Production (≤2k units, single shift): 3–7 days

- QC, assembly, and packing: 2–5 days

- Logistics to North America/EU:

- Air: 5–9 days door-to-door for small consignments.

- Ocean: 18–28 days on fast services, 28–40 days typical depending on lane and port congestion.

Putting it together

- Simple parts, aluminum, single cavity: 4–6 weeks PO to first shipment

- Medium complexity, P20: 6–8 weeks

- Transparent optics, inserts, or tight tolerance: 8–10 weeks

Section 3: What Really Moves MOQ and Lead Time

Mold Strategy

Aluminum / bridge tooling Best for 200–2,000 pieces. Faster to cut (7–12 days typical), lower cost, and easier to iterate. Tool life in the range of 10k–30k shots depending on resin and maintenance.

P20 tool steel Workhorse choice for longer runs. Typical life 50k–100k shots. Slightly longer lead time than aluminum, but stable and repeatable. Often used for ABS/PP housings with cosmetic requirements.

Cavitation

More cavities reduce unit cost and compress production time, but raise mold complexity and balancing challenges. Multi-cavity also increases mold cost and may extend the initial build timeline.

Materials and Colorants

- Friendly: ABS, PP, HIPS

- Sensitive: PC (especially transparent optics), POM (shrinkage/warpage management), PA6/PA66 + GF (abrasion, moisture conditioning), TPU/TPE (gating and demolding considerations)

Geometry and Surface Requirements

Thin walls (<1.2 mm), ribs, bosses, living hinges, and deep ribs influence fill and cooling, and commonly trigger more DFM rounds.

Cosmetic standards (high gloss, texture etching, mirror finish for optics, visible parting lines) prolong polishing and texture steps and increase the likelihood of additional sampling rounds.

Factory Capacity and Seasonality

Busy seasons (Q3–Q4) often add 1–2 weeks to tool build or production scheduling.

Logistics and Compliance

For urgent launches or crowd-funding deliveries, air makes sense for the first 100–200 kg. For cost efficiency, ocean is usually the default beyond that.

Section 4: A Practical MOQ and Lead-Time Matrix for Small Batches

Use this as a starting point for negotiation and internal planning. Replace the placeholders with your own data as you build supplier quotes.

| Goal | Typical Setup | Realistic MOQ | Est. Lead Time (PO → first shipment) | Notes |

|---|---|---|---|---|

| EVT pilot build | Aluminum, single cavity, ABS, no painting | 200–500 | 4–6 weeks | Lowest risk, fastest iteration |

| Bridge to DVT/PVT | P20, single or dual cavity, ABS/PP | 500–1,500 | 6–8 weeks | Unit cost drops with cavitation |

| High cosmetic parts | P20, polish/texture, transparent PC optional | 800–2,000 | 7–10 weeks | Expect T2/T3 iterations |

| Inserts + assembly | P20, inserts, assembly, functional testing | 1,000–2,000 | 8–10 weeks | Fixtures, torque tests, traceability |

Section 5: Cost Logic—Why MOQs Land Where They Do

Think of cost as three buckets: fixed (mold), semi-fixed (setup, changeover, purging, fixture prep), and variable (material, cycle-time-driven machine hours, labor, packaging, QC).

Mold amortization

A USD 3,000 aluminum tool adds $15 per unit at 200 pcs; $6 at 500 pcs; $3 at 1,000 pcs. A USD 7,000 P20 tool adds $35 at 200 pcs; $7 at 1,000 pcs; $3.5 at 2,000 pcs.

Cycle time and machine rates

If cycle time is 35–45 s on a 180T press at $18–28/h machine rate, each added cavity or optimized cooling saves hours across the batch.

Scrap and yield

Early runs may see 2–5% scrap. Complex resins or optical finishes can push initial scrap higher until parameters stabilize.

Secondary operations

Painting, printing, ultrasonic welding, or sub-assembly often add $0.10–$0.60 per unit and 1–3 days in schedule.

Logistics

Air vs ocean changes landed cost per unit by $0.05–$0.80 depending on weight/volume and route.

Section 6: Data-Backed Examples

Example A: Handheld enclosure (ABS, 2.0 mm wall, aluminum, single cavity)

- Tooling: $2,800

- DFM: 3 days, two rounds

- Mold build: 12 days

- T1 at day 13, minor gate vestige touch-up

- T2 at day 18

- Batch: 500 units, 38 s cycle, one-shift schedule; production + QA 3 days

- Shipment: air at day 33

- Unit economics: at 500 units, amortization ~$5.60/tooling per part; total unit cost (illustrative) $1.9 landed; at 1,500 units, ~$1.2 landed

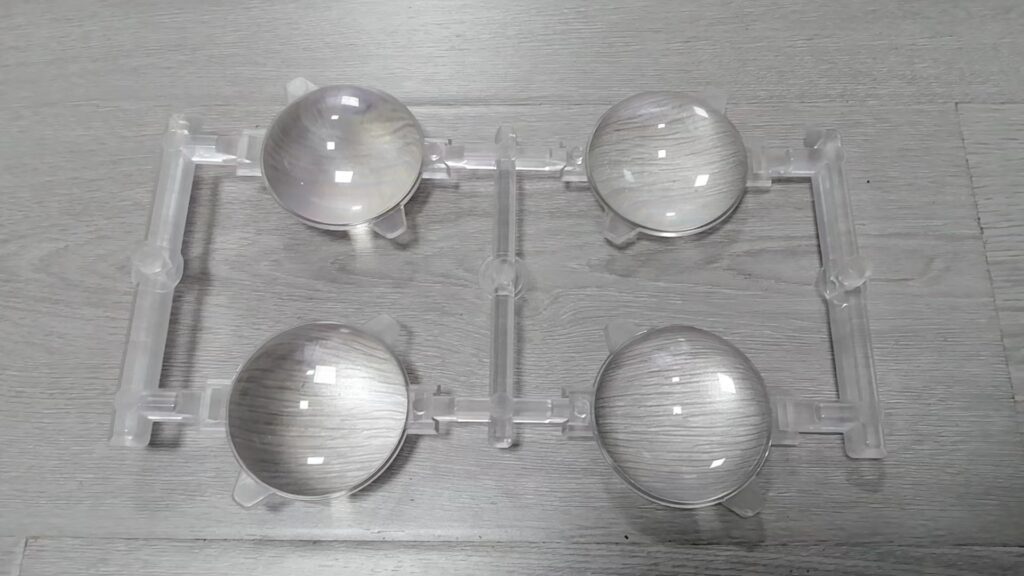

Example B: Transparent lens (PC, mirror polish, S136, single cavity)

- Tooling: $8,500

- DFM: 4 days, three rounds with gate relocation

- Mold build: 25 days

- T1 at day 19 with flow lines; T2 at day 26 after polish/vent updates

- Batch: 1,000 units, 42 s cycle; plus 2 days painting/screen printing

- Shipment: ocean fast service at day 49

- Unit economics: at 1,000 units, ~$2.8 landed; at 2,000 units, ~$2.1 landed

Section 7: Negotiating a “Real MOQ” and a Credible Lead Time

What to request in quotes

- Two tooling options: aluminum single cavity and P20 with 1–2 cavities, with explicit mold steel designation, runner type (cold/hot), expected tool life, and spare inserts policy.

- Unit pricing at tiers (e.g., 200 / 500 / 1,000 / 2,000 units) with +/- lead-time impact by cavitation.

- Sampling plan: How many T1 parts included? How many no-cost iterations (T2/T3) and what qualifies as “minor” vs “steel change”?

- Production cadence: Cycle time estimate, shots/hour, shift assumptions, and overtime capability.

- Quality and documentation

- QC: AQL level and inspection points (visual, dimensions, functional), first-article report format, gauge/fixture plan, COA and material batch traceability.

- Compliance: RoHS/REACH, UL flammability (if needed), ISO 9001/13485/IATF credentials, and how certificates are verified.

- Change control: Engineering change cutoff dates, PPAP/FMEA availability for automotive-like rigor.

Logistics clarity

- Two shipping scenarios (air vs ocean) with estimated transit times, incoterms (EXW/FOB/CIF/DDP), packaging specs (carton dimensions, gross weight), and palletization.

Section 8: Lead-Time Risk Register and Mitigations

Common risks

- DFM churn due to under-specified draft angles, thin ribs, or aggressive cosmetic requirements.

- Material supply hiccups for specialty grades or color-matched resins.

- Overloaded polishing/EDM/texturing queues during peak seasons.

- Surprise compliance retests or labeling missteps that hold freight.

Mitigations

- Share CAD (STEP/IGES) with a DFM checklist upfront: draft angles, wall thickness, rib-to-wall ratios, gate/vent strategy, ejector placement, and parting line visibility.

- Lock a mold strategy early: aluminum for speed and iteration vs P20 for stability and longevity.

- Freeze cosmetic standards with ranked priorities: areas critical to end-user vs hidden interior surfaces.

- Pre-book capacity for polishing/texturing and get a named owner for the tool on the supplier side.

- Create two logistics plans: air for first 100–200 kg and ocean for replenishment, with cartonization planned early.

Section 9: Simple Calculators You Can Recreate

Economic MOQ estimator

Inputs: Tooling cost, target amortization per part, variable unit cost, expected batch sizes.

Output: Recommended batch size where total per-unit cost flattens.

Example:

- Tooling $3,000; variable cost $0.85; target amortization ≤ $1.50/part

- Economic MOQ ≈ 2,000 parts (because $3,000 / 2,000 = $1.50). If budget prefers ≤ $2.00 all-in, you might greenlight 1,200–1,500 parts to balance cash and speed.

Lead-time estimator

Inputs: DFM rounds, mold type, cavitation, complexity factor, sample rounds, batch size, shift schedule, logistics mode.

Output: Gantt-style forecast. For a 500-piece ABS housing with aluminum single cavity and two sample rounds, expect 4–6 weeks to first shipment.

Section 10: Data Table and Chart You Can Embed

Use the table below for a more granular view by mold/material combo. You can convert it to a WordPress table block or HTML table. The chart following it visualizes lead-time expectations; replace numbers with your data if needed.

| Setup | Typical Tooling | Realistic MOQ | Tool Build (days) | Sampling Rounds | Production (≤2k) | Total to Ship |

|---|---|---|---|---|---|---|

| Aluminum, single cavity, ABS | $2.5k–$3.5k | 200–800 | 10–14 | 1–2 | 3–5 days | 4–6 weeks |

| P20, single cavity, ABS/PP | $5k–$7k | 500–1,500 | 12–18 | 1–2 | 4–6 days | 6–8 weeks |

| P20, single cavity, transparent PC | $6k–$9k | 800–2,000 | 16–22 | 2–3 | 4–7 days | 7–10 weeks |

| P20, dual cavity, ABS/PP | $7k–$11k | 1,000–2,000 | 16–24 | 1–2 | 3–4 days | 6–9 weeks |

Optional chart (ASCII for reference; convert to an image later)

Lead Time by Setup (Weeks)

- Aluminum, single, ABS | ██████ (4–6)

- P20, single, ABS/PP | ████████ (6–8)

- P20, single, transparent PC | ██████████ (7–10)

- P20, dual, ABS/PP | ████████ (6–9)

To embed a visual chart in WordPress, export a simple bar chart from Excel/Sheets using the table data above and add it as an image. Caption it with your assumptions.

Section 11: RFQ and DFM Templates to Increase Speed

What to include in your RFQ

- CAD: STEP/IGES with clear part version and revision date

- Material: Resin grade and color code where possible (e.g., SABIC CYCOLAC ABS MG47F)

- Cosmetic: SPI finish, texture code, paint spec, silk-screen PMS colors

- Tolerances: Critical-to-quality dimensions with GD&T callouts

- Volumes: Tiered quantities (200 / 500 / 1,000 / 2,000) and replenishment assumptions

- Compliance: RoHS, REACH, UL, other regulatory requirements

- Sampling: Required number of T1/T2 parts and test plan

DFM self-check highlights

- Draft angles ≥ 1° on cosmetic faces (more for textured sections)

- Uniform wall thickness; rib thickness ~0.5–0.6× wall to prevent sink

- Gate plan that keeps vestiges away from cosmetic zones

- Ejector layout that avoids witness marks on critical surfaces

- Venting strategy for long flow paths, especially in thin walls

- Fillets to relieve stress concentrations at boss bases and rib intersections

Section 12: Example Timelines You Can Reuse Internally

Scenario 1: 500 ABS housings, aluminum single cavity

- Week 1: DFM and mold design approval

- Week 2–3: Tooling fabrication

- Week 3 end: T1 samples; review and minor polish

- Week 4: T2 confirmation; pilot run scheduling

- Week 5: Production + QA + packing

- Week 5–6: Air shipment, import, delivery

Scenario 2: 1,000 clear PC lenses, P20 single cavity

- Week 1: DFM with focus on gates/vents and cosmetic standards

- Week 2–3: Tool fabrication, polishing

- Week 3–4: T1; address flow lines, polish; T2 at end of week 4

- Week 5: Production + painting/screen printing

- Week 7: Ocean fast service; arrival by week 10 depending on lane

Section 13: Common Misconceptions, Corrected

Misconception:

“Factories won’t touch <1,000 units.”

Reality:

Many shops in South China will accept 200–500-piece batches if the tooling and DFM are straightforward and you present a clear replenishment plan or future ramp.

Misconception:

“Lead time is always 8+ weeks.”

Reality:

For simple ABS enclosures with aluminum tooling, 4–6 weeks to first shipment is realistic with fast DFM and crisp decision-making.

Misconception:

“Aluminum molds can’t hold tolerances.”

Reality:

For many small housings and non-optical parts, aluminum bridge tools hold production-grade tolerances for 10k–30k shots when built and maintained correctly.

Section 14: Supplier Shortlist Criteria

- Process capability: Photos and machine list (tonnage spread, hot runner experience)

- Metrology: CMM/vision systems, gauge R&R habits, first-article reporting

- Toolroom depth: EDM, high-speed CNC, polishing bench capacity, texture partners

- Documentation: ISO 9001/13485/IATF where applicable, traceability of resin lots

- Communication: English-capable project manager, response times, weekly status formatting

- References: Case studies in your material category, sample QA reports

Section 15: Call to Action and Assets

- Offer two-path quoting: aluminum vs P20, with explicit lead-time and MOQ deltas

- Provide a downloadable DFM checklist and an RFQ template

- Include a simple calculator (Sheet) to estimate economic MOQ and lead time

- Invite STEP/IGES file submission with 48-hour preliminary feedback

Conclusion

Small-run injection molding in China is not only feasible—it’s often the fastest way to validate your product and bridge to larger production. If you align on the two MOQs that matter, choose a mold strategy that reflects your launch goals, and manage DFM with discipline, you can hit a 4–8 week window reliably for 200–2,000 units. Use the tables as your negotiation anchor points, lock in your QC and logistics assumptions early, and you’ll minimize surprises while keeping burn and timelines under control.

FAQ

Q: What is a realistic MOQ for small-run injection molding in China?

A: 200–1,000 units production-side for simple parts; economic MOQ typically 800–2,500 units depending on tooling and complexity.

Q: How long does it take from PO to first shipment?

A: Simple aluminum single-cavity ABS parts: 4–6 weeks. P20 and high-cosmetic or transparent parts: 6–10 weeks.

Q: Can I start with aluminum and later upgrade to P20?

A: Yes. Aluminum is ideal for bridge tooling and fast iteration; P20 is preferred for higher volumes and tighter repeatability over longer tool life.

Q: What pushes timelines out the most?

A: Late cosmetic changes, underestimated polishing/texturing, and material/color matching. Seasonality and logistics choices also impact the schedule.

Q: How do I protect my IP when sending CAD?

A: Use an NDA, watermark revisions, share only necessary geometry early, and choose suppliers with a clear document control policy and traceable access. “`